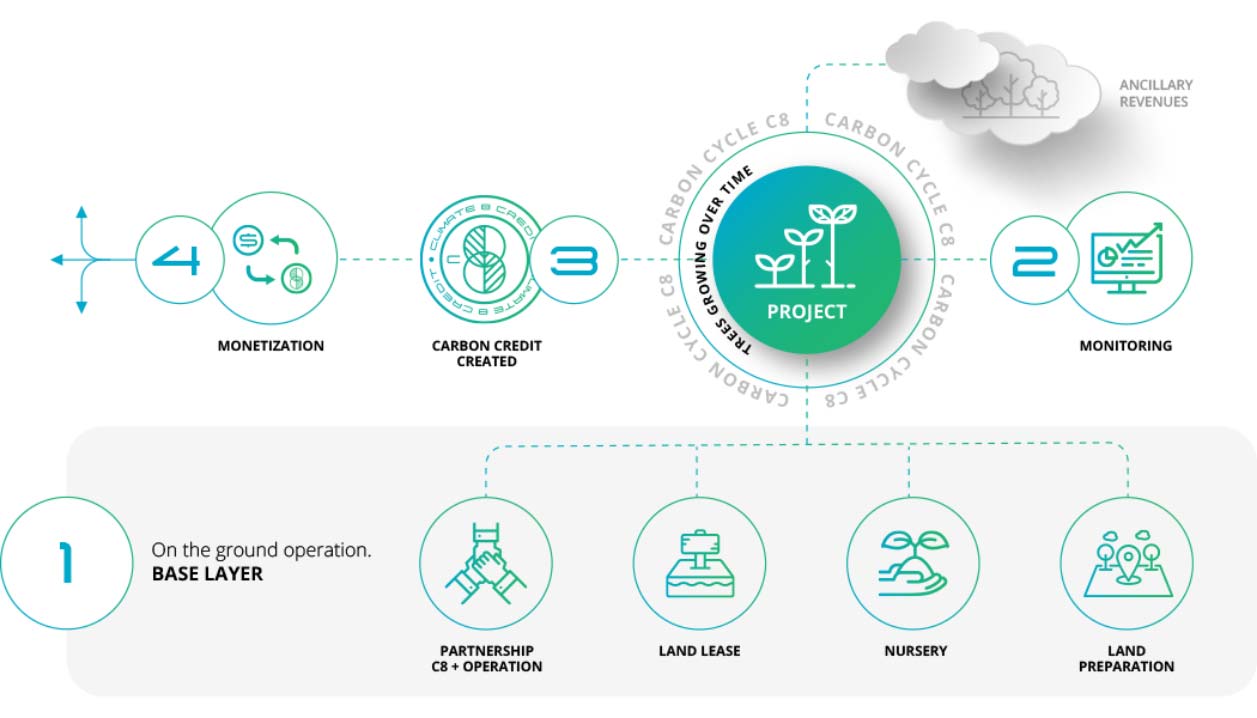

Holistic framework

for investment selection

Our projects must adhere to the highest

and most widely accepted carbon standards

for Nature Based Solutions.

Our projects must adhere to the highest and most widely accepted carbon standards for Nature Based Solutions.

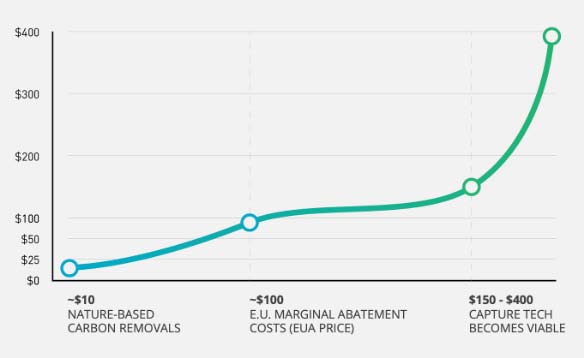

We are at an inflection point in the demand for voluntary carbon credits

Limited availability

Limited number of high-fidelity credits coupled with exponential demand from the voluntary market will drive price appreciation. High-fidelity credits are those with significant co-benefits that trade at a premium to quoted market prices.

Potential problems

Critics commonly cite several hurdles to ultimate price appreciation including lack of standardization and transparency, inadequate trading infrastructure, and market integrity.

Our solution

Climate 8 offers investors a way to navigate these hurdles by gaining exposure to carbon credits through a publicly listed vehicle.

Our criteria for the project we work on.

1. Rigorous Selection Process

We must control the project, the land and the carbon. Must have co-benefits as an “add on” to carbon as it is fundamental to long term project viability:

- Project needs to have a business case beyond carbon.

- Large plots of degraded land with low population

density are important so people are not displaced.

2. Project Due Diligence

With a focus on underlying project operations. Excellent climate and soil, high biological growth and carbon sequestration, large scalable areas of suitable land, infrastructure such as water and logistics, potential for Forest Stewardship Council (FSC) or Programme for the Endorsement of Forest Certification (PEFC) certification.

3. Carbon Certification Process

We take full control and ownership of the certification process and own the resulting carbon. We only go forward with projects that will attain Verra or Gold Standard accreditation standards.

How we

are different